Compared with the previous year, unit sales grew slightly by 1.3%. Although the Volkswagen brand was able to boost deliveries in the first half (+4.6%), its unit sales were at about the prior-year level as a result of lower third-party production within the Volkswagen Group.

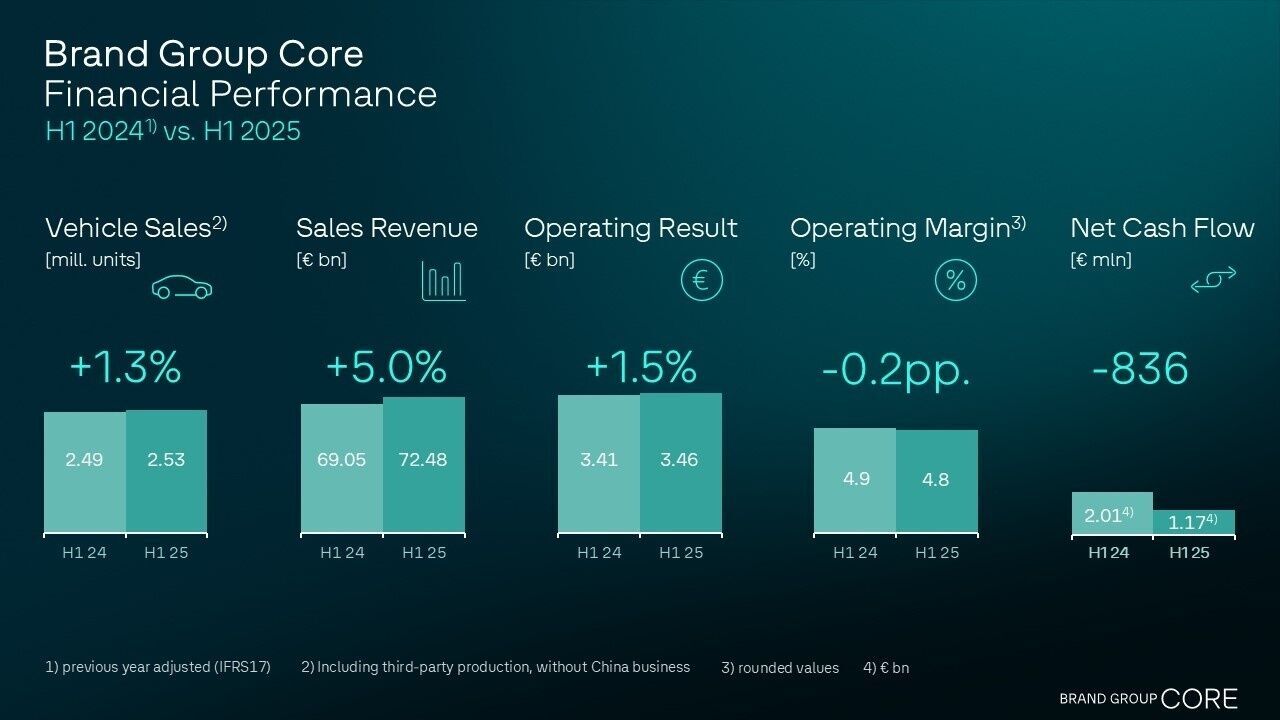

Brand Group Core improves sales revenue and achieves progress in cost efficiency

In the first half of 2025, the Volkswagen, Škoda, SEAT/Cupra and Volkswagen Commercial Vehicles brands significantly improved sales revenue (+5.0%) to about 72.5 billion euros in a challenging market environment. Despite the adverse impact of significantly higher US import tariffs, it was possible to boost the operating result of the Brand Group Core to 3.46 billion euros. Key factors in this solid result are the rejuvenated product range, improved capacity utilization at the plants, reduced factory costs – and therefore the consistent implementation of the agreed restructuring initiatives.

“In a challenging first half, we have proved that we are now leveraging the potential of the Brand Group Core. Our new models have been outstandingly well received by the market and improved efficiency in production is having a perceptible positive effect. We are on the right track and now need to continue our efforts consistently in this direction. We are vigorously pursuing our performance programs at the same time as investing in future-oriented topics such as shorter innovation cycles, battery technology and software quality. The next major step will be our Electric Urban Car Family, which will make entry-level mobility attractive and affordable in Europe.”

“We are achieving progress in improving our cost efficiency. Since the beginning of the year, we have already recorded a fall in factory costs – underscoring the first positive effects of our comprehensive cost optimization initiatives. This development is the result of disciplined operational implementation. Targeted measures are making our production processes leaner and improving capacity utilization at our plants. The resulting positive dynamic confirms our consistent commitment to successfully implementing the restructuring measures we have initiated – and laying the foundation for sustainable profitability and financial stability.”

Key Figures

In a tough competitive environment, the sales revenue of the Brand Group Core increased significantly by 5.0%, supported by price increases, an improved product mix and a slight increase in unit sales.

The first effects of the measures taken to improve cost efficiency are becoming apparent. Despite the adverse impact of higher US import tariffs, costs arising in connection with CO2 regulation, restructuring costs and litigation expenditure connected with the diesel issue, it was possible to increase the operating result of the Brand Group.

In spite of the challenges faced following a sluggish start to the year, the operating margin almost reached the prior-year level.

Net cash flow was considerably affected by cash outflows in connection with US tariff policies.

Overview of the brands in the Brand Group Core:

Volkswagen Passenger Cars

In the first half of 2025, Volkswagen Passenger Cars recorded stable unit sales of 1,521,278 vehicles (without China). Although the Volkswagen Brand was able to boost deliveries by 4.6% in the first half of the year as a result of rising sales of the models ID. 3, ID. 4, Polo, Tiguan and T-Cross as well as the successful market launch of the Tayron, overall unit sales were at about the prior-year level as a result of lower third-party production within the Volkswagen Group. Sales revenue ran at 43.45 billion euros, 3.0% higher than the comparable prior-year figure. The operating result was boosted by 20.3% to 1.10 billion euros. The consistent implementation of the efficiency measures agreed at the end of last year is having a positive impact on the cost structures of the Volkswagen brand despite the adverse impact of US import tariffs, restructuring costs and the diesel issue, the operating margin rose to 2.5% compared with the prior-year value of 2.2%. Excluding the impact of these non-operating effects, the performance of the Volkswagen Brand was stronger and lies within the target corridor for the year as a whole.

Škoda Auto

in the first half of 2025, Škoda Auto was able to build on the successes of the 2024 financial year – the best ever in its history. In the first six months of the year, Škoda Auto grew its global deliveries by 13.6% to 509,400 vehicles and became Europe's third-best-selling passenger car brand. Strong demand for electric and plug-in hybrid models played a key role in this development. Almost every fourth Škoda sold in Europe (22.8%) is equipped with an electrified powertrain. The strong sales figures are also reflected in the financial results of the company. Sales revenue grew to 15.07 billion euros (+10.4%) and the operating result reached 1.285 billion euros (+11.8%), with a stable operating margin of 8.5% – also thanks to the consistent implementation of the Next Level Efficiency program.

SEAT/CUPRA

With 302,600 vehicles delivered in the first half of 2025, SEAT/CUPRA recorded a rise of 1.7% compared with the previous year. At the same time, sales revenue fell slightly by 2.0% to 7.6 billion euros. The operating result also fell, compared with the prior-year level, to 38 million euros as a result of changes in the sales mix, EU import tariffs on the CUPRA Tavascan produced in China, rising material costs and tougher competition in key markets.

Volkswagen Commercial Vehicles

Volkswagen Commercial Vehicles (VWN) boosted its sales revenue by 7.6 percent to 8.70 billion euros in the first half of 2025 – despite a slight fall of 3 percent in unit sales with reference to the comparable prior-year value. In the second quarter, the brand was able to significantly improve its key figures: operating result, unit sales, deliveries and sales revenue were significantly above the level in the first quarter of 2025. Unit sales of the ID. Buzz were especially gratifying, with growth of almost 70 percent compared with the first half of 2024, including the variants ID. Buzz Cargo, LWB , GTX and Pure. Incoming orders for the ID. Buzz also grew significantly to 42 percent above the prior-year level. In the second quarter, the operating result developed positively. Following 37 million euros in the first quarter, VWN recorded an operating result of 170 million euros in the period from April to June. The cumulative operating result for the first half of the year is therefore 207 million euros. The operating margin improved accordingly, from 0.9 percent in the first quarter to 2.4 percent after six months. However, the figure is still lower than the operating margin for the first half of 2024. The main reasons are the introduction of a new generation of T models, a generally challenging and in some cases shrinking market for light commercial vehicles and provisions in connection with CO₂ fleet regulations in Europe.

Review

Especially high capacity utilization at the plants and the targeted optimization of production processes brought additional efficiency gains. Demand for models such as the Polo, Tiguan, T-Cross, T-Roc, Golf, Tiguan, Passat and Tayron continued at a high level, while all-electric models, especially the ID.3 and ID.4, as well as the Formentor, Elroq and Envaq, proved to be growth drivers.

The unit sales of the Volkswagen Brand remained at the prior-year level as a result of lower third-party production within the Volkswagen Group. In the second quarter, there was significant progress both with regard to products and with regard to prices.

Outlook

Over the coming years, the Brand Group Core will focus consistently on implementing the restructuring measures that have been agreed within the brands. Despite the remaining uncertainties, the brand group expects that the second half of the year will be stronger in overall terms. The cooperation of the volume brands within the “Electric Urban Car Family” project is proceeding according to schedule. From 2026 onwards, the Brand Group Core will launch electric vehicles at a price of about 25,000 euros under the project led by SEAT/CUPRA. The four planned models – two from the Volkswagen brand and one each from CUPRA and Škoda – will be built at the Spanish plants in Martorell and Pamplona. Collaboration on the “Electric Urban Car Family” project alone will unlock synergy potential at brand group level totaling about 650 million euros across the entire product life cycle.

Over the next few years, the Brand Group Core therefore plans continuous improvements in its results, supported by the effects of the ongoing performance programs of the volume brands, including the “Zukunft Volkswagen” program.

Intensive efforts are underway to implement the measures that have been decided – and thus generate a pathway to a medium-term operating margin of 8% for the Brand Group Core.

Key figures for the Brand Group Core:

Key financials | H1 2025 | H1 2024 | Change 25 /24 |

Unit sales (thousand units including vehicles of other brands) | 2,527 | 2,494 | 1.3% |

Sales revenue | 72.480 billion € | 69.051 million € | 5.0% |

Operating result | 3.455 billion € | 3.405 billion € | 1.5% |

Operating margin | 4.8% | 4.9% | -0.2% points |

Net cash flow | 1.17 billion € | 2.01 billion € | 836 million € |

Key figures for the brands belonging to the Brand Group Core:

Unit sales | Sales revenue | Operating result | Operating margin | |||||

1000 units/ | H1 | H1 | H1 25 | H1 24 | H1 | H1 | H1 25 | H1 24 |

Volkswagen Passenger Cars | 1,521,278 | 1,518,756 | 43,448 | 42,194 | 1,103 | 917 | 2.5% | 2.2% |

Škoda Auto | 582,010 | 547,690 | 15,070 | 13,652 | 1,285 | 1,149 | 8.5% | 8.4% |

SEAT/CUPRA | 321,930 | 344,313 | 7,598 | 7,752 | 38 | 406 | 0.5% | 5.2% |

Volkswagen Commercial Vehicles | 224,436 | 231,262 | 8,698 | 8,087 | 207 | 635 | 2.4% | 7.9% |