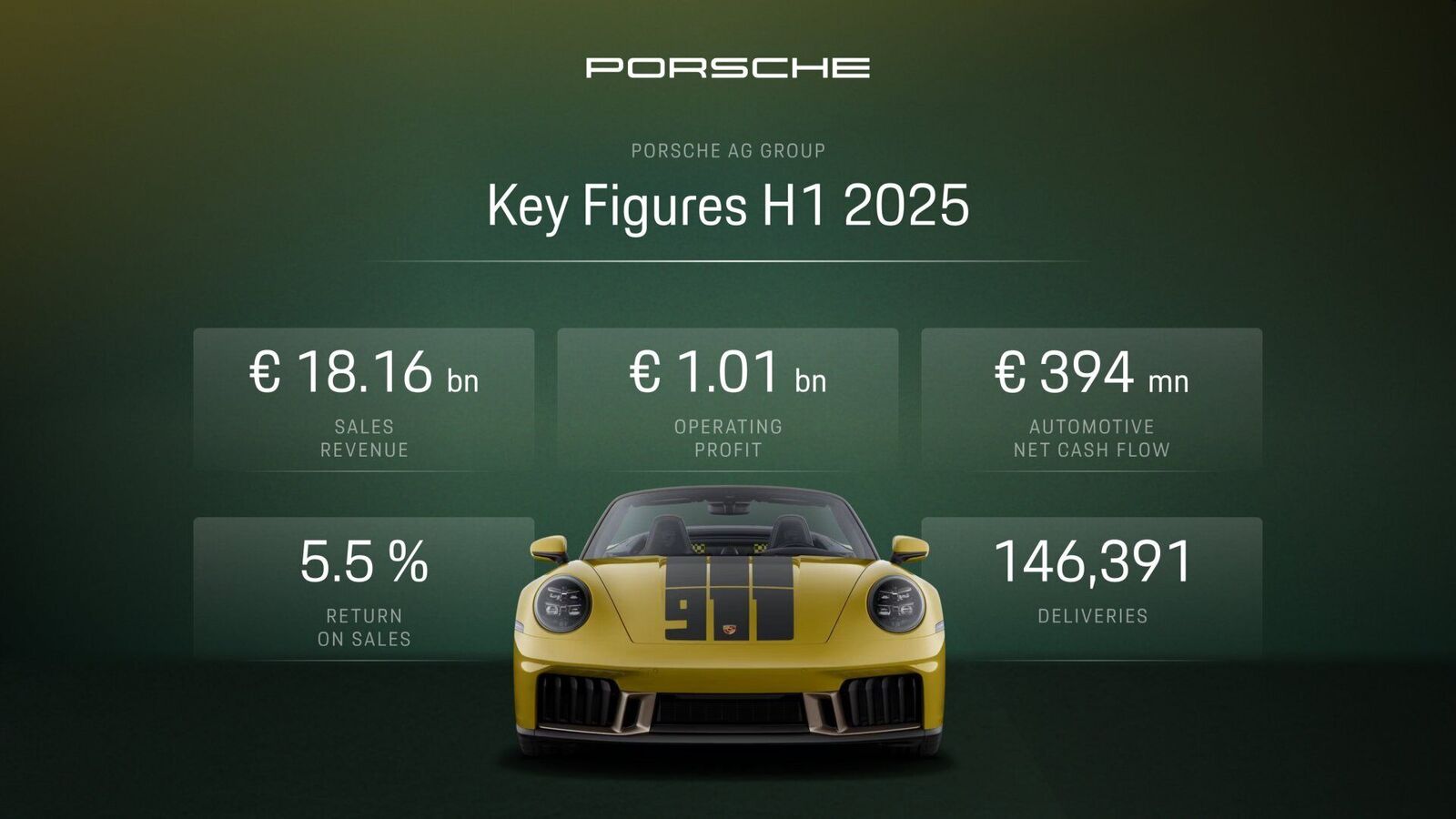

In the first six months of 2025, the sports car manufacturer generated a group sales revenue of 18.16 billion euros (previous year: 19.46 billion euros). Group operating profit amounted to 1.01 billion euros (previous year: 3.06 billion euros). The group operating return on sales was 5.5 per cent (previous year: 15.7 per cent).

Porsche AG pushes ahead with strategic realignment

- Macroeconomic and geopolitical headwinds weigh substantially on half-year results. Porsche responds with comprehensive strategic realignment measures.

- Extensive rescaling and a more flexible product portfolio are its objectives.

- Special charges of around 1.1 billion euros, including for battery activities, US tariffs and the strategic realignment.

- Group sales revenue in the first half of the year at 18.16 billion euros, with operating profit at 1.01 billion euros.

- Record deliveries in North America as well as in the Overseas and Emerging Markets.

- The proportion of electrified vehicles in Europe is around 57 per cent, exceeding the target set at the time of the IPO.

- Success in quality ranking and in motorsport.

- CEO Oliver Blume: “The world is changing dramatically. That's why we are fundamentally developing Porsche. Our completely revamped product range is very well received by our customers. We therefore expect that we will begin to see positive momentum again from 2026 onwards.”

- CFO Dr Jochen Breckner: “The aim of our strategic realignment is to strengthen our profitability and resilience.”

Porsche AG is resolutely pushing ahead with its strategic realignment in the second half of 2025 in the face of a challenging global environment.

Business performance was impacted by ongoing macroeconomic and geopolitical challenges. “We continue to face significant challenges around the world. And this is not a storm that will pass. The world is changing dramatically – and, above all, differently to what was expected just a few years ago. Some of the strategic decisions made back then appear in a different light today. That is why we are fundamentally developing Porsche further,” says Oliver Blume, Chairman of the Executive Board of Porsche AG. “Our completely revamped product range is very well received by our customers. We expect that we will begin to see positive economic momentum again from 2026 onwards.”

According to Blume, three factors in particular are shaping the current situation for Porsche: “In China, demand in the premium and luxury segment has fallen sharply. In the US, import tariffs are also putting huge pressure on our business. Looking ahead, the movement of the dollar could also have an impact. In addition, the transformation to electric mobility is progressing more slowly than expected overall, with consequences for the supplier network.” In light of these conditions, Porsche’s management is resolutely pushing ahead with extensive measures to rescale and recalibrate the company. In the first half of 2025, special expenses for the company's realignment amounted to around 200 million euros, and to around 500 million euros for battery activities. The US import tariffs resulted in an additional burden of 400 million euros because Porsche offered its customers price protection.

Second package of measures to be negotiated with employee representatives

“The aim of our strategic realignment is to strengthen our profitability and resilience,” says Dr Jochen Breckner, Member of the Executive Board for Finance and IT. In the second half of this year, Porsche will start negotiations with employee representatives on a second package of measures, as announced. “In order to make Porsche fit for the future, we will discuss far-reaching approaches,” says Breckner. "These measures are expected to have a positive impact on earnings and cash flow in the coming years.”

Automotive net cashflow amounted to 394 million euros (previous year: 1.12 billion euros). The automotive net cashflow margin was 2.4 per cent (previous year: 6.3 per cent). In the first half of this year, Porsche delivered 146,391 vehicles to its customers worldwide. Of these, 36.1 per cent were electrified. This percentage is made up of 23.5 per cent all-electric vehicles and 12.6 per cent plug-in hybrids. In Europe, the proportion of electrified vehicles was around 57 per cent. This exceeded the target set at the time of the IPO. The best-selling model was the Macan, with 45,137 deliveries worldwide. Porsche set new delivery records in North America as well as in the Overseas and Emerging Markets.

“We will continue to manage supply and demand in close coordination with our sales regions in accordance with our 'value over volume' strategy. This is based on our highly attractive product range and the strength of our brand,” says Breckner. “We are also seeing positive momentum from our individualisation offerings.”

Planned ramp-up of battery cell production at V4Smart

A few months after the founding of V4Smart GmbH, the Porsche AG subsidiary has reached its first milestone with the second production line in Nördlingen (Bavaria) now ramped up as planned. Alongside the line in Ellwangen, it is currently the only production facility in Europe for high-performance lithium-ion round cells.

Porsche has also performed well in terms of quality. In the recently published J.D. Power APEAL study in the US, Porsche ranked first among all manufacturers in customer perception. In motorsport, the sports car manufacturer achieved an impressive double victory last weekend. At the season finale of the Formula E in London, Porsche won the world championship title in both the team and manufacturer standings. Prior to that, Porsche celebrated its second consecutive class victory in the LMGT3 category at the 24 Hours of Le Mans with the Porsche 911 GT3 R. In the overall standings, the Porsche 963 finished second at Le Mans after a thrilling finale.

Forecast for 2025 adjusted after tariff agreement

Following the EU Commission's agreement with the US government on import tariffs, Porsche has adjusted its outlook for 2025. This takes into account the expected effects of the new tariffs as well as the tariff effects that have been in place since June, which had not yet been included in the previous forecast. The updated forecast now includes expected import tariffs of 15 per cent from August 1, as well as potential countermeasures such as price adjustments. These are designed to mitigate the financial impact. Porsche continues to expect group sales revenue in the range of 37 to 38 billion euros. This is in line with the previous forecast. At the lower end of the range, Porsche expects a group return on sales of 5 per cent and an automotive net cashflow margin of 3 per cent. At the upper end of the range, a group return on sales of 7 per cent and an automotive net cashflow margin of 5 per cent are expected. The upper end remains in line with the original forecast from the end of April. The outlook includes expected special effects related to the strategic realignment, amounting to around 1.3 billion euros.

| Porsche AG Group | H1 2025 | H1 2024 | Alteration |

| Sales revenue | €18.16 billion | €19.46 billion | -6.7% |

| Operating profit | €1.01 billion | €3.06 billion | -67.0% |

Operating return on sales | 5.5% | 15.7% | |

Deliveries to customers | 146,391 | 155,945 | -6.1% |

Disclaimer

This press release contains forward-looking statements and information that reflect Dr. Ing. h.c. F. Porsche AG's current views about future events. These statements are subject to many risks, uncertainties, and assumptions. They are based on assumptions relating to the development of the economic, political, and legal environment in individual countries, economic regions, and markets, and in particular for the automotive industry, which we have made on the basis of the information available to us and which we consider to be realistic at the time of publication. If any of these risks and uncertainties materializes or if the assumptions underlying any of the forward-looking statements prove to be incorrect, the actual results may be materially different from those Porsche AG expresses or implies by such statements. Forward-looking statements in this presentation are based solely on the circumstances at the date of publication. We do not update forward-looking statements retrospectively. Such statements are valid on the date of publication and can be superseded. This information does not constitute an offer to exchange or sell or an offer to exchange or buy any securities.